refinance closing costs transfer taxes

Assuming seller closing costs run 8 of the sales price including the real estate commission deductible closing costs on the rental property sold for. Mortgage interest paid when cost was settled.

Understanding Mortgage Closing Costs Lendingtree

The amount of the funding fee is based on down payment and if its a purchase or refinance as well as whether its your first time or a subsequent use of your VA benefits.

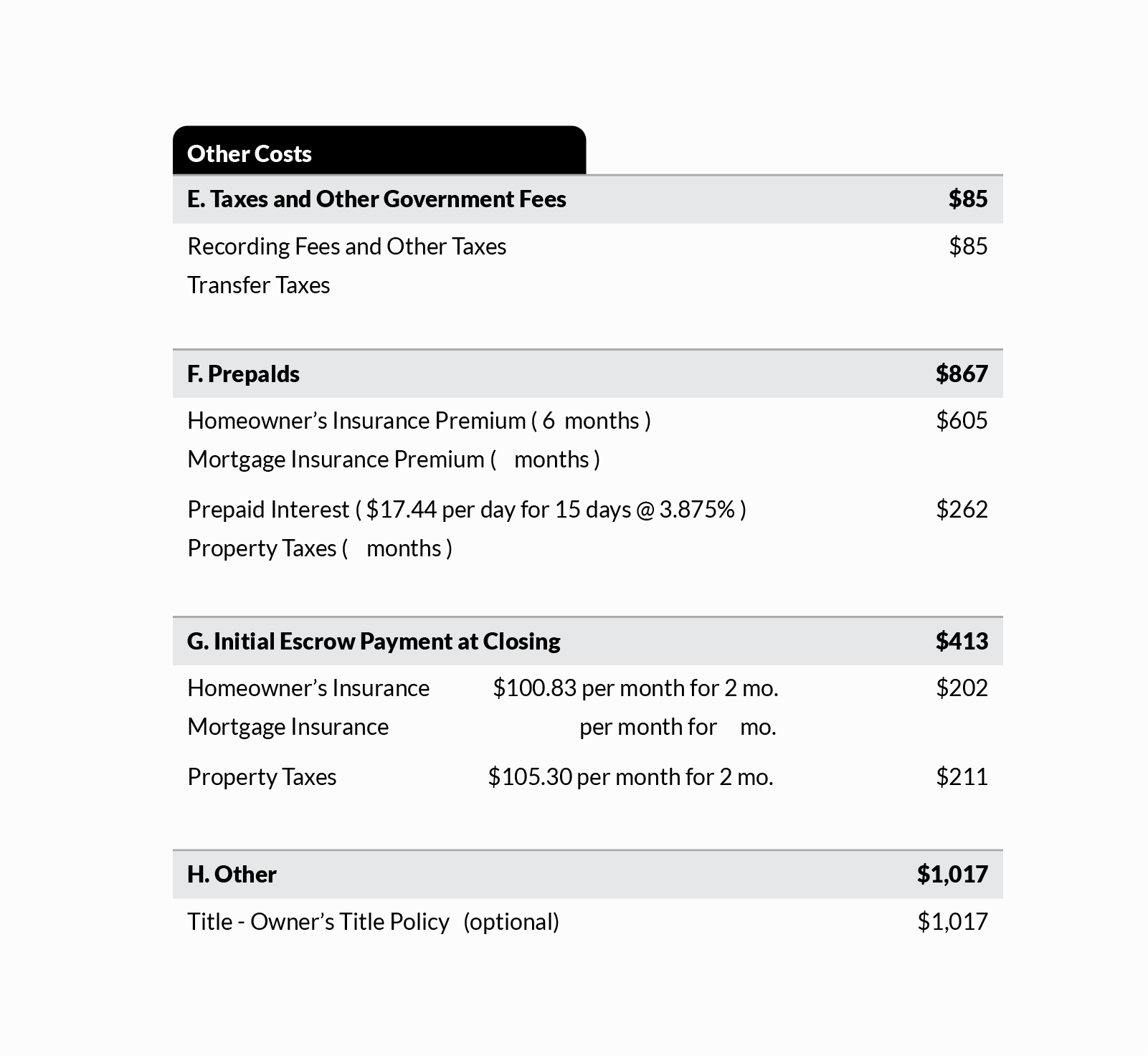

. Beware of the catch though. Escrow costs for property taxes and homeowners insurance Your closing costs will vary depending on the new loan amount your credit score and. Doc Prepatty fees.

Typical closing costs for a buyer of a 250000 home might range between 5000 and 12500. Transfer taxes are usually expressed. You cant completely deduct all the costs of closing on your house.

Below is a state-by-state breakdown of average closing costs with and without taxes. You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined. Only a few eligible ones make the cut.

Although some lenders may reduce or waive them altogether home equity loan closing costs typically range anywhere from 2 to 5 of the loan amount. In exchange for an available cost reduction or waiver if you pay off and close the loan within a certain period usually three years you may. Closing Costs Calculator Photo credit.

The IRS denotes the following as deductible costs. Real estate transfer taxes are different from property tax estate tax and gift tax. Home equity loan closing costs and fees.

How much are the average estimated closing costs for buyers. Who pays closing costs. Sales tax issued at closing.

Average Closing Costs By State. Private mortgage insurance PMI These costs may be paid outright at closing or in some cases built into the loan. Real estate taxes that were paid for by the mortgage lender.

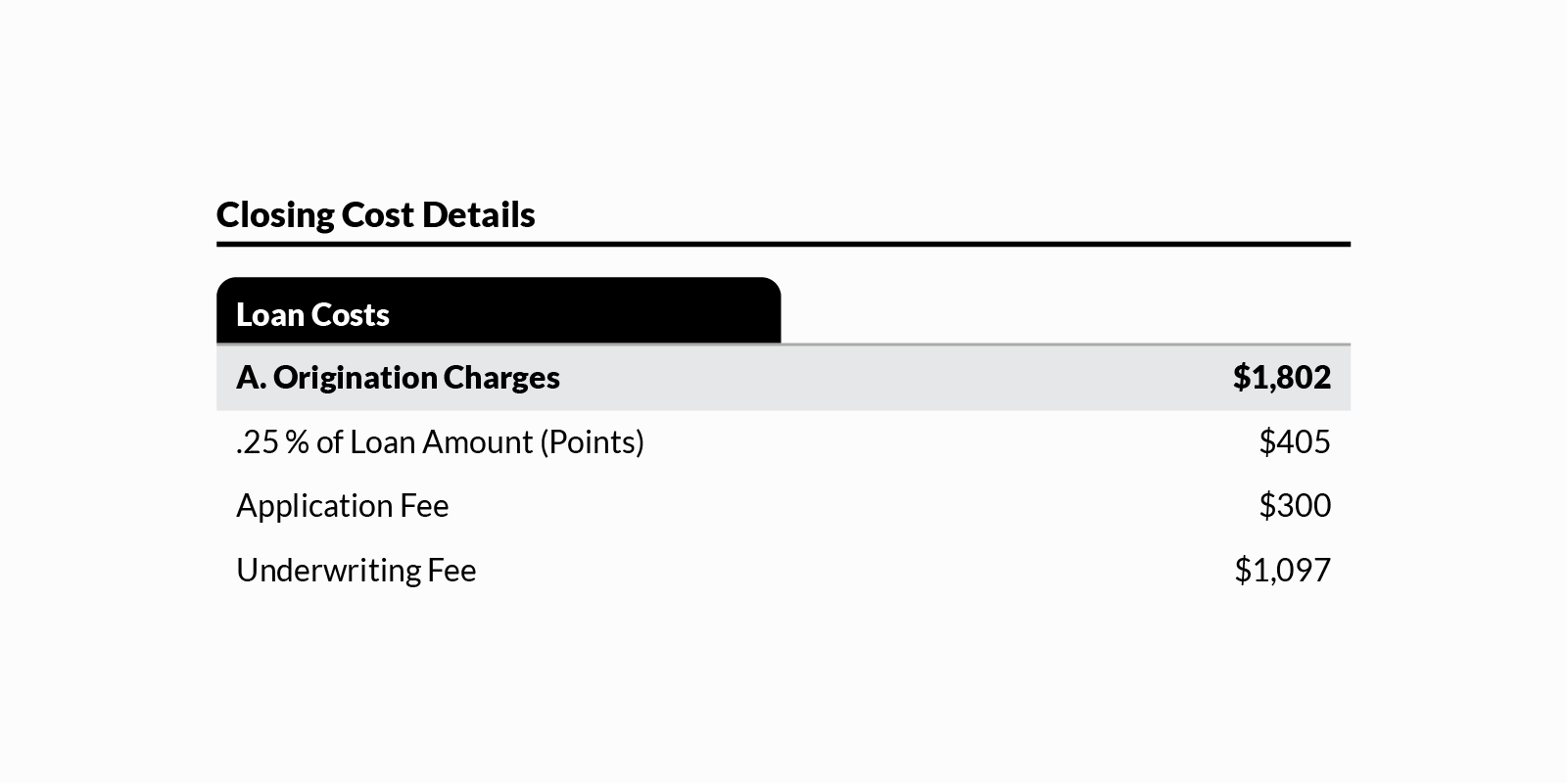

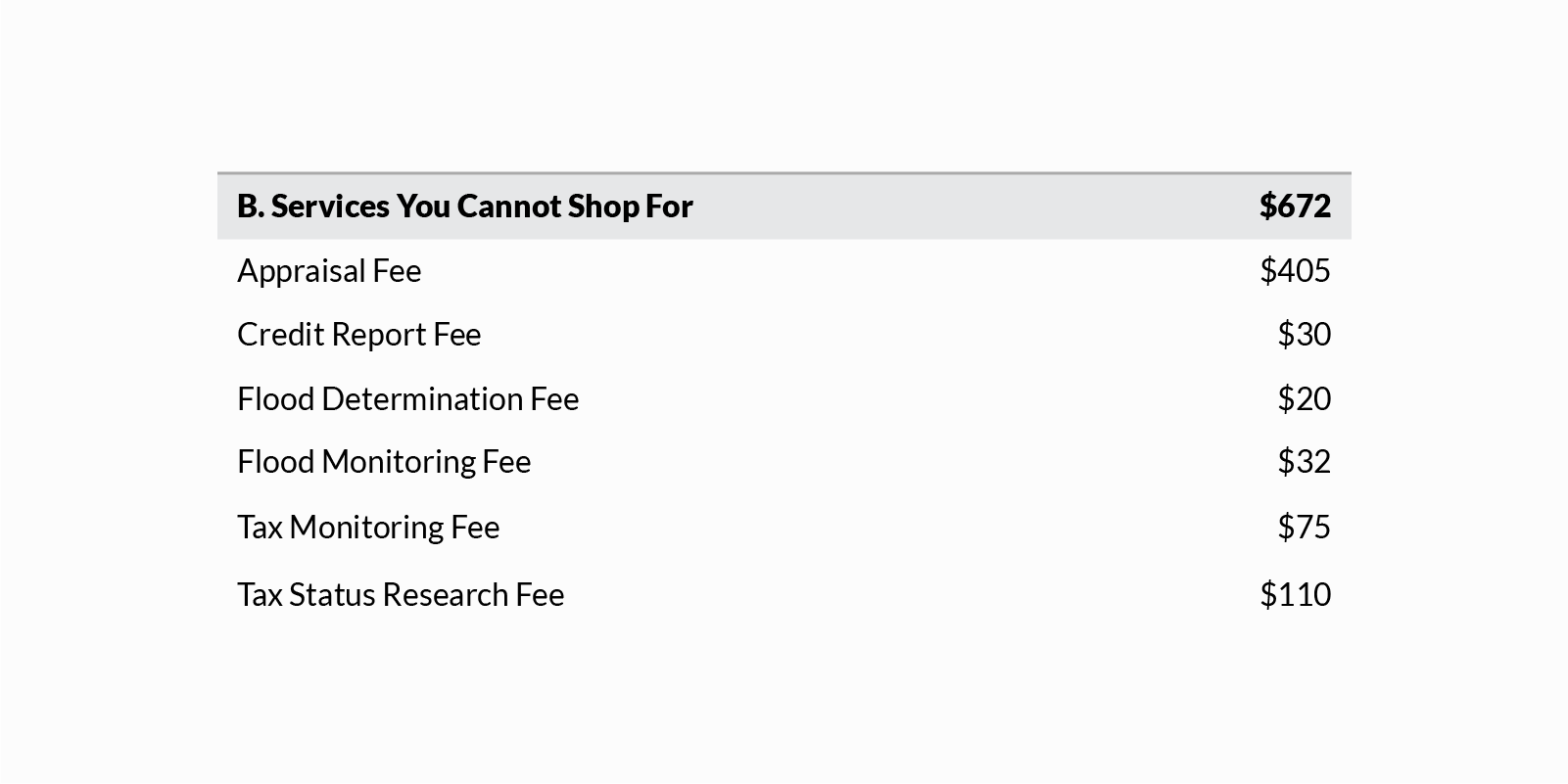

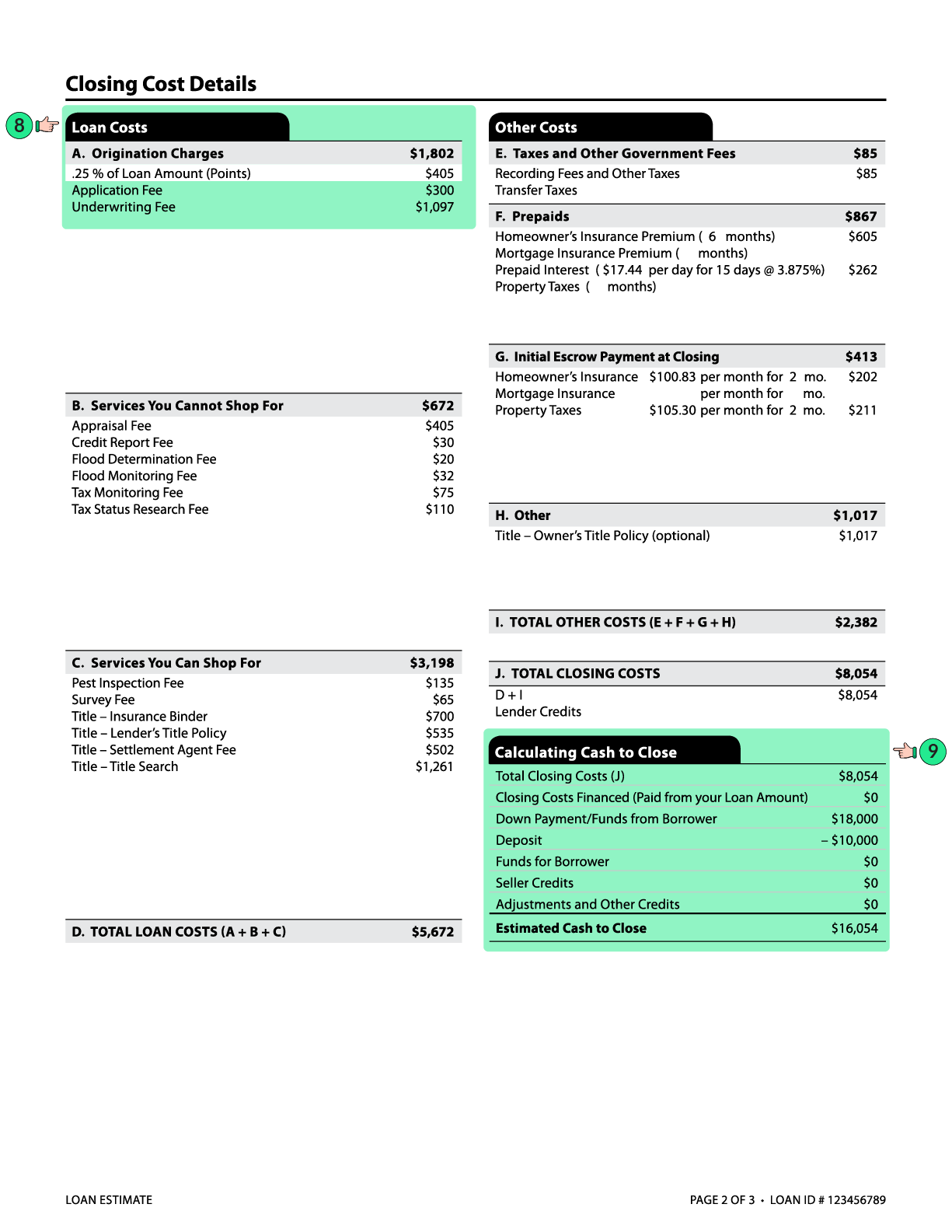

In fact we replicate an entire Loan Estimate that you would get from a potential lender for your specific area. In addition to paying closing costs. Real estate taxes charged to you when you closed.

Buyer closing costs are often 2 to 5 of the home purchase price. 185 copies. Homebuyers in the US.

The report released Monday by CoreLogic found the states with the highest average closing costs excluding specialty taxes were Hawaii at 4730 New York at 4679 Florida at 3956 Texas at. Title fees insurance calculator MD Title Insurance rates Local closing attorney. Maryland closing costs Transfer taxes fees.

Sellers can deduct closing costs such as real estate commissions legal fees transfer taxes title policy fees and deed recording fees to lower the profit and lower the potential taxes owed. These are closing costs. Including title insurance inspection fees appraisal fees and transfer taxes.

Closing costs vary from lender to lender and state to state but generally include. Pay on average 5749 for closing costs including taxes according to a 2019 survey from ClosingCorp a real estate closing cost data firm. Closing costs may be rolled into the loan amount or be paid at closing depending on the loan program loan characteristics.

Understanding Mortgage Closing Costs Lendingtree

Understanding Mortgage Closing Costs Lendingtree

What Is A Loan Estimate How To Read And What To Look For

What Is A Loan Estimate How To Read And What To Look For

Understanding Mortgage Closing Costs Lendingtree

Closing Costs Ontario You Must Know Before Buying Or Selling Property

No Closing Cost Mortgage Is It Actually Worth It Credible

Refinance Closing Costs Remain At Less Than 1 Of Loan Amount In 2021 Corelogic S Closingcorp Reports

Escrows Prepaids At Closing What You Should Know U S Mortgage Calculator

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Closing Costs When Paying All Cash For A Home Financial Samurai

What Are Closing Costs Jay Villella Real Estate Consultant

Closing Costs That Are And Aren T Tax Deductible Lendingtree

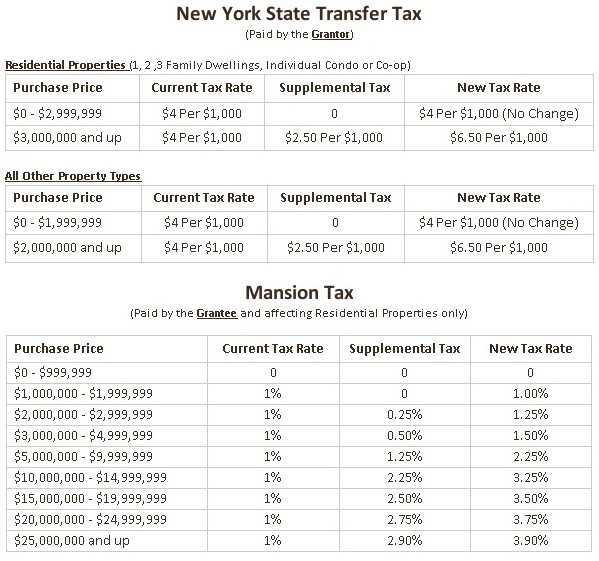

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

The Complete Guide To Closing Costs In Nyc Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Are Real Estate Transfer Taxes Forbes Advisor

Real Property Transfer Tax Increase The Judicial Title Insurance Agency Llc